Investors who want to take a more hands-on approach to investing, choosing individual stocks, may take a look at the debt-to-equity ratio to help determine whether a company is a risky bet. Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock. As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry. A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt.

Related Terms

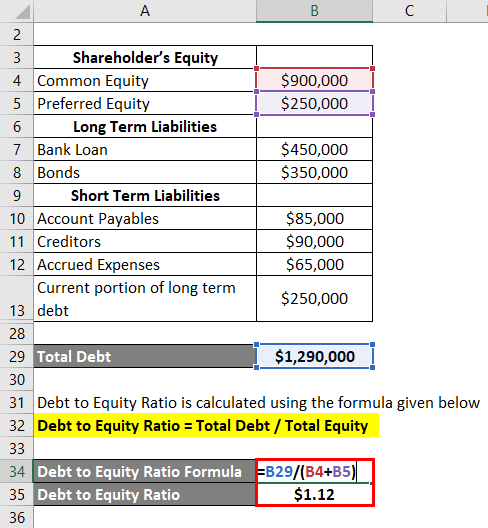

This ratio helps indicate whether a company has the ability to make interest payments on its debt, dividing earnings before interest and taxes (EBIT) by total interest. Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement. To look at a simple example of a debt to equity formula, consider a company with total liabilities worth $100 million dollars and equity worth $85 million. Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18.

Analyzing the Debt-to-Equity (D/E) Ratio by Industry

The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies. The debt-to-equity ratio can clue investors in on how stock prices may move. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations.

What Is Leverage?

- Reviewing it, along with any additional financial information, can give a well-rounded picture of the companys financial stability.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- It enables accurate forecasting, which allows easier budgeting and financial planning.

- The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies.

When calculating the debt to equity ratio, you use the entire $40,000 in the numerator of the equation. A company’s debt is its long-term debt such as loans with a maturity of greater than one year. Equity is shareholder’s equity or what the investors in your business own.

Debt Ratio

But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk. A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt.

Step 2: Identify Total Shareholders’ Equity

It gives a fast overview of how much debt a firm has in comparison to all of its assets. Because public companies must report these figures as part of their periodic external reporting, the information is often readily available. While using total debt in the numerator of the debt-to-equity ratio is common, a more operational management challenges revealing method would use net debt, or total debt minus cash in cash and cash equivalents the company holds. If you’re an equity investor, you should care deeply about a firm’s ability to make debt obligations, because common stockholders are the last to receive payment in the event of a company liquidation.

Youre probably wondering what the debt-to-equity ratio (D/E ratio) is and why its important. The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022. Let’s look at a few examples from different industries to contextualize the debt ratio. Firms whose ratio is greater than 1.0 use more debt in financing their operations than equity. Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more.

Different industries have varying capital requirements and growth patterns, meaning that a D/E ratio that is typical in one sector might be alarming in another. Capital-intensive sectors, such as utilities and manufacturing, often have higher ratios due to the need for significant upfront investment. In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios. Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk. While the D/E ratio is primarily used for businesses, the concept can also be applied to personal finance to assess your own financial leverage, especially when considering loans like a mortgage or car loan.

Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. Current assets include cash, inventory, accounts receivable, and other current assets that can be liquidated or converted into cash in less than a year. However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake. A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. Let’s examine a hypothetical company’s balance sheet to illustrate this calculation.

Companies that are heavily capital intensive may have higher debt to equity ratios while service firms will have lower ratios. In the previous example, the company with the 50% debt to equity ratio is less risky than the firm with the 1.25 debt to equity ratio since debt is a riskier form of financing than equity. Along with being a part of the financial leverage ratios, the debt to equity ratio is also a part of the group of ratios called gearing ratios. The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance sheet to the value of its total shareholders’ equity.